Home loans. If only they were as easy as calling a bank, asking (pretty please) for some money, and then throwing a housewarming in your new place.

Because in reality? There are rules. Requirements. Boxes to tick. Hoops to jump through.

But it’s all so you (and the lender) can make sure you’re making a good home loan decision — one that you’ll be able to comfortably afford in years to come.

So, what’s the home loan process?

Let’s dive into how to get a home loan, from your first meeting with a broker all the way to settlement.

How to get a home loan

1. Know your property goals

The first step to getting a home loan is, well, deciding you want to buy a property.

And that includes asking yourself (and your partner if you’re in it together) WHY you want to buy a property. Questions like…

- What are my money and lifestyle goals?

- Do I want to live in the property? Or is it an investment?

- Where do I want to live (and for how long)?

- What are my non-negotiables in a property?

Once you’re clear on your property goals, you’re ready to start the home loan process (which you can take as fast or slow as you like).

2. The first meeting with a broker

Property goals? Tick.

Now you’re in a great position to chat with a broker (or home loan expert, as we like to call them).

Buuuuut we get it, “meeting with a mortgage broker” can sound downright overwhelming. Scary, even.

But the truth is, a mortgage broker’s sole purpose is to support YOU through the home buying process — step by step. And that means they’re there to guide you and answer questions if you’re totally new to this (we’ve got you).

On top of knowing your goals, you can prepare for your first meeting with a home loan expert by pulling together a rough idea of your income and expenses. You might also decide to prepare some questions to ask your home loan expert.

But wait, how do you *actually* meet with a mortgage broker?

Well, we can’t speak on behalf of all mortgage brokers. But with Finspo, you can get started by providing a few details online, then booking a time to meet with one of our experts via video call. Together we’ll chat through your goals and needs. Easy.

If you’re ready to get the ball rolling, then the next step would be to upload your docs, discuss your home loan options and start the pre-approval process…

3. Pre-approval process begins

A crucial step to getting a home loan — pre-approval is like a conditional thumbs up from your lender to borrow money.

It’ll tell you how much they’re willing to lend you and what your mortgage repayments will likely be, which means you can start hunting for your new home with greater confidence because you know what you can afford.

The pre-approval process usually starts after your first meeting with a broker — when you’ve decided you’re ready to get things moving. You’ll typically be asked to pull together docs like ID, pay slips from the last 3 – 6 months, your most recent payment summary, current expenses and bank statements (yep, there’s no sidestepping paperwork here).

Once that’s done, your home loan expert can put together some great loan options to discuss with you and help you find the right fit. They’ll then handle the heavy lifting to apply for pre-approval on your behalf (phew).

The pre-approval process can take anywhere from a few hours to a few weeks (often it depends on your circumstances and the lender). This is why it’s a good idea to engage a home loan expert as early as possible. Check out how long home loan pre-approval takes — we’ve got you covered.

Oh, and once the pre-approval process is underway, it’s a great time to engage a conveyancer (AKA someone who helps with the home and land transfer process and checks over important details in the contract of sale). They’ll come in handy when you start to search for a home.

4. Search for a home (booyah!)

Now you know what you can afford thanks to pre-approval, the fun part begins: house hunting (like, for real this time, not just your Saturday arvo sticky-beak).

Narrow down your search according to your budget and revisit the goals you came up with earlier. This includes weighing up your needs. Things like outdoor areas, number of bedrooms, number of bathrooms, schools, public transport, main roads, shops, cafes, entertainment, surrounding suburbs… You get the gist.

Ask yourself which features are non-negotiable and which ones you’d be willing to forgo if you had to (psssst: there are usually a few things you’ll need to compromise on).

Then, once you’ve found a home you can picture yourself kicking back in, the next step is to ask the real estate agent for a “contract of sale.” A contract of sale is often accompanied by supporting documents which, together, provide information that may affect the value of the property. Things like title details, building or planning permits, services connected, and details on outstanding mortgages. The nitty-gritty stuff.

And if your eyes are starting to glaze over like a Krispy Kreme doughnut, it’s time to ring in the experts.

The experts on your team often include a…

- Broker (AKA home loan expert) — the link between you and the lender and a super handy person to ask questions along the way (if we do say so ourselves). See the pros and cons of working with a mortgage broker vs a bank directly.

- Conveyancer — as we mentioned in pre-approval, they’re someone who helps with the home and land transfer process and checks over important details in the contract of sale.

- Pest inspector — as the name suggests, they’ll look over the property to inspect whether there are any termites or pests (and any damage caused by them).

- Building inspector — they inspect the safety and structural quality of the property, then alert you of any potential problems so there are no unwanted surprises.

- Buyer’s advocate — kinda like a real estate agent, but for YOU the buyer. Not everyone uses one but they are helpful if you want support when searching for, evaluating and negotiating your purchase.

5. Make an offer

The pinnacle of adulting — you’re ready to make an offer on a property.

The two most common ways to make an offer are through a private sale or auction.

In a private sale, you’ll usually submit your offer to the real estate agent who’ll relay it to the vendor. Then, take a deep breath. Your job is done and it’s up to the vendor now.

As for an auction, this is held at a set date and time (usually with a fast-talking, overly-enthusiastic auctioneer). The property is sold once the highest bid is reached and the auctioneer declares it ‘sold’ , provided it’s over the minimum amount the seller will accept.

And, what a lot of people may or may not tell you is that placing offers can be a rollercoaster — especially if you have to go through the process a few times before an offer sticks. So, try to approach each offer with your expectations in check.

The most important thing is only to make an offer within your capacity which includes the funds you already have available and the funds your lender has indicated they may lend you based on the pre- approval. Your broker will help you establish your limits for bidding at an auction or making an offer at a private sale. This includes making allowances for taxes, stamp duty, lenders mortgage insurance (where applicable) and fees. The last thing you want to do is to make an offer that is accepted but it is above your limit, as it’s possible the lender will not increase the loan it will provide you (the ultimate sticky situation). That’s why working with a home loan expert through your journey is so important.

6. Offer accepted

The property *almost* has your name on it.

The offer is accepted when you and the vendor sign the contracts at an agreed price and you’ve paid a deposit. Booyah.

But you’re not across the finish line juuuuust yet.

Once the offer is accepted, the real estate agent will send the signed contract to both parties’ lawyers or conveyancers and they’ll run over every last detail to make sure everything is good to go.

Now we’re getting to the home loan part: your conveyancer will send the fully executed copy of the contract to your mortgage broker, who’ll work closely with your lender to formally approve your loan. It’s also a great time to revisit any government grants or incentives you may be eligible for.

Remember, *deep breaths* — and a good broker should keep you in the loop throughout this journey (our application tracker comes in handy too).

7. Unconditional approval

If pre-approval is an encouraging thumbs up, then unconditional approval is a fully committed double thumbs up.

Yep, unconditional approval happens when your lender officially agrees to lend you money. Hoorah!

And when we’re talking about how to get a mortgage, this is where the action happens…

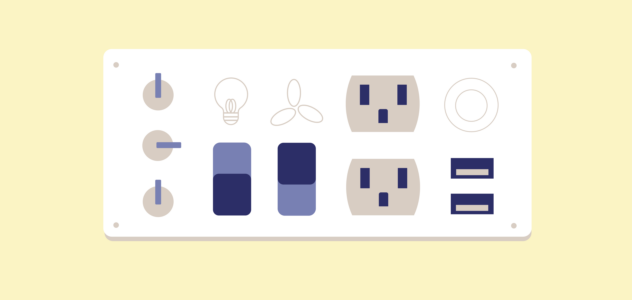

It’s time to finalise the home loan type you’ll take out. It’s totally normal to see changes from your pre-approval to suit the exact home loan you need. On top of this, now’s the time to make a final call on things like…

- A principal and interest vs interest-only home loan?

- Should you get a fixed-rate home loan?

- Should you get an offset account?

You may have already weighed up these options during the pre-approval process, but you’ll always get the opportunity to check back in and see if it’s still a good fit.

8. Settlement day

Property settlement is a legal process that usually takes 30 – 90 days from unconditional approval (but not always — there are exceptions).

Then when settlement day rolls around, ALLLL of your hard work finally pays off and the ownership passes from the seller to you.

But there are a few things that need to happen on settlement day (or in the lead up to it) before you grab the keys and call in the moving vans.

Things like…

- Complete a final inspection to make sure the property is in the same condition as when it was sold to you (this is usually done around a week before settlement day)

- While most documents will be signed and prepared prior to settlement day, settlement day is where both parties (and their teams) finalise, double-check and exchange paperwork

- With help from your lender, the balance of the purchase price will be paid to the seller

- There’ll be a new mortgage registered (under your name) against the property title

- Your conveyancer will also check over any important details (like all caveats being removed and the existing mortgage being discharged)

- You’ll also need to pay land transfer tax or stamp duty

Once all of that is signed, sealed and delivered, you’ll *officially* have a home loan to your name and be ready to collect the keys from the real estate agent.

We know, it seems like a *lot* of steps are involved in settlement. But remember, you’re not alone — your broker is there to walk you through, and answer any questions you have in the lead up to settlement.

9. Dance through your living room

As you can see, there’s a fair bit involved in the steps to get a home loan. But, it’s all worth it when the time comes to pick up your keys and dance through your (yes, YOUR) living room.

And once you’ve got your home loan, this will stay with you until you pay it off or until you decide to refinance to pay it off faster (but that’s another story for down the track).

At Finspo, our brokers make the steps to get your first home loan simple. We like to be your first port of call — every step of the way — so you’re not left scratching your head staring down at a pile of paperwork. Phew!

So if you’re ready to learn more, get started online and tee up your first meeting with a broker – they’ll happily answer your questions, with no obligation.

Book your time with a Finspo home loan expert today.